Payroll tax expense formula

Form 941 is used to report wages withholdings and calculate Social Security and Medicare taxes. Each worker pays the same 765 tax through payroll withholdings.

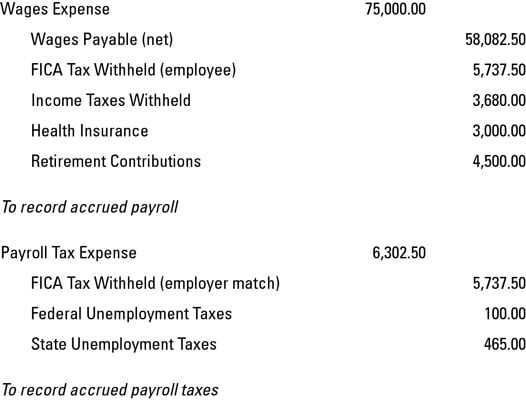

Payroll Journal Entries For Wages Accountingcoach

Need formula for budgeting payroll taxes.

. Multiply the number of withholding allowances the employee has claimed on his W4 form by the amount of one allowance for his filing status and the length of the pay period. All Services Backed by Tax Guarantee. Subtract 12900 for Married otherwise.

Employer FICA Tax Liability Total 11475 9180 15300. Payroll Expenses refers to the total cost associated with hiring and retaining employees and independent contractors on your payroll. Enter General Information About Paying Your Employees.

Get Your Quote Today with SurePayroll. You need to match each employees FICA tax liability. Ad Choose Your Calculator Tools from the Premier Resource for Businesses.

Say on your spreadsheet Col A has Name of the employees and column B has. Annual Salary on column C copy this formula on. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Payroll Expenses Formula ƒ. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Multiply 062 times total wages to figure Social Security tax expense.

Currently employers pay a 62 Social Security tax and a 145 Medicare tax 765 in total. The payroll expense tax is levied upon businesses not individual. Free Unbiased Reviews Top Picks.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Get Started Today with 2 Months Free. Remember this is less than 1.

How do I do payroll in QuickBooks. Multiply the gross pay by 06 or 0006. As of 2021 the rate is divided between a 62 deduction for Social Security on a maximum salary of 142800 147000 for the 2022 tax year and a 145 share for Medicare.

Since this is the first payroll of the year the employee has only earned 48000 and is well below the 10000 threshold. The standard FUTA tax rate is 6 so your max. The payroll expense tax is a tax on employers that have Seattle annual payroll expense of 7386494 or more.

Ad Compare This Years Top 5 Free Payroll Software. Now onto calculating payroll taxes for employers. 2020 Federal income tax withholding calculation.

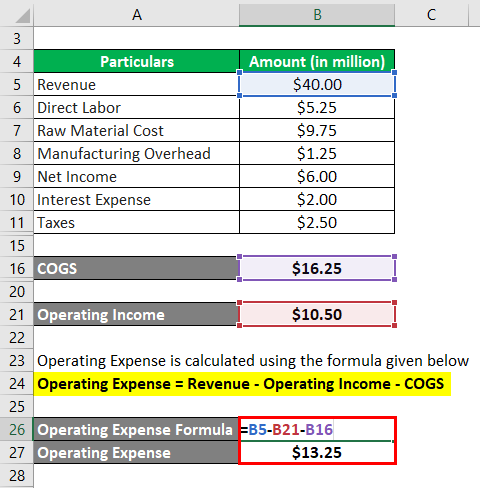

Operating Expense Formula Calculator Examples With Excel Template

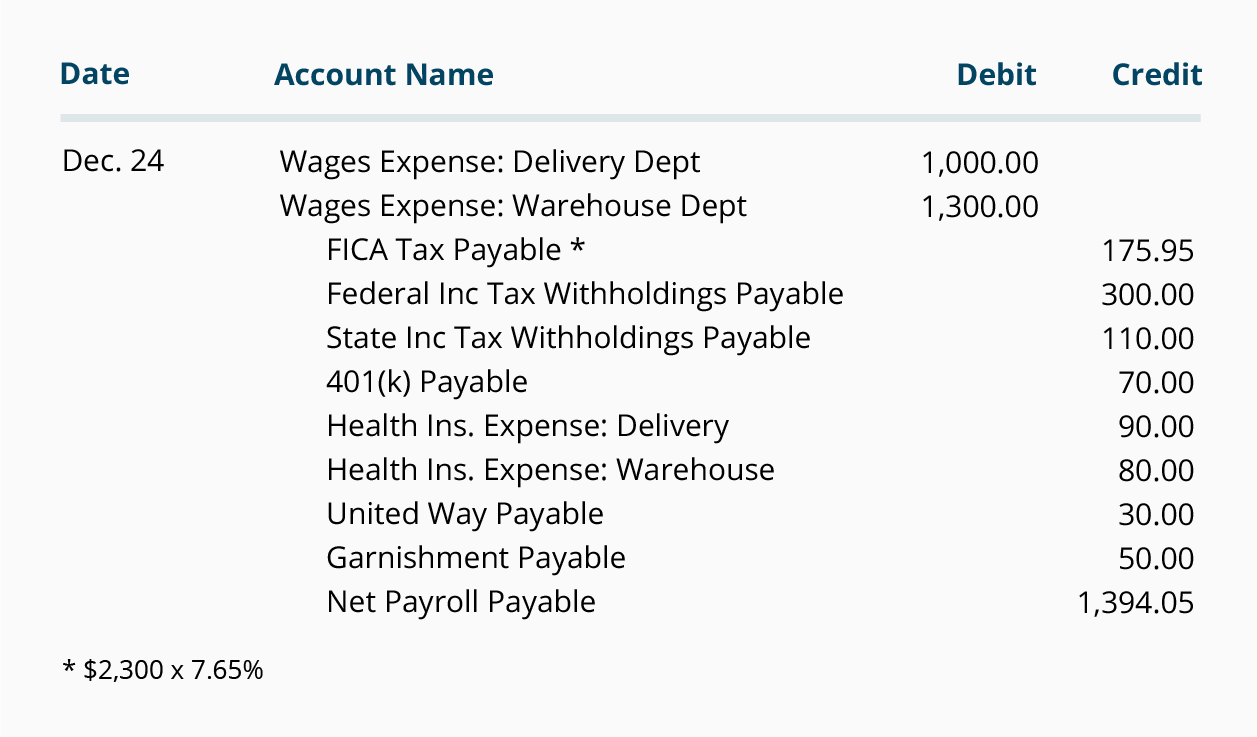

Payroll Journal Entries For Wages Accountingcoach

How To Calculate Taxes On Payroll Clearance 52 Off Www Ingeniovirtual Com

Payroll Tax Calculator For Employers Gusto

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Journal Entries Youtube

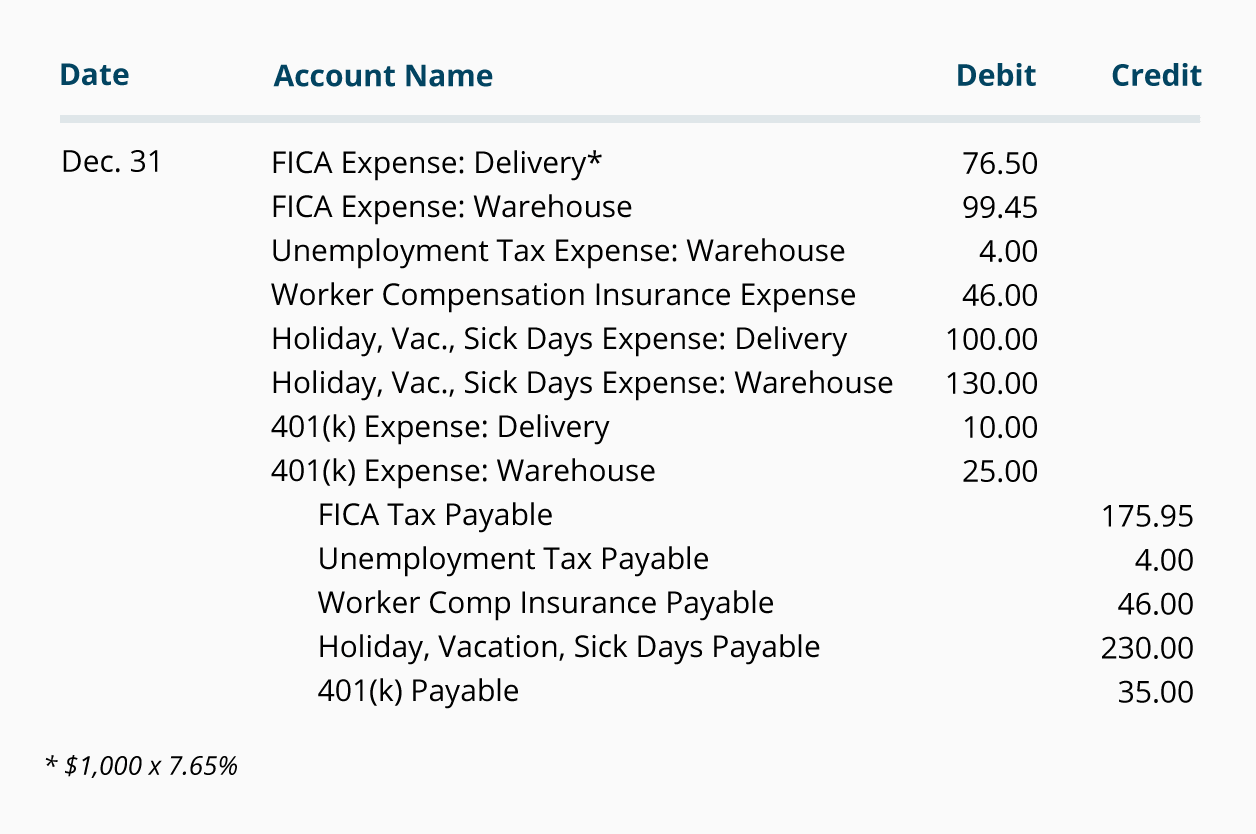

How To Record Accrued Payroll And Taxes Dummies

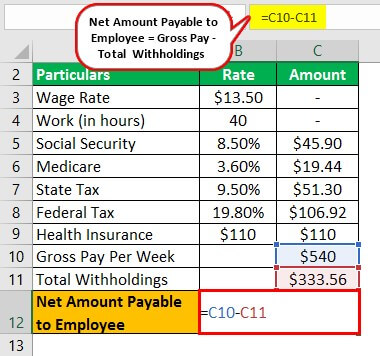

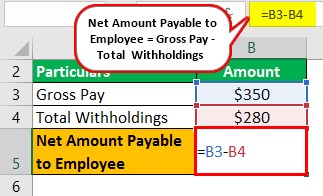

Payroll Formula Step By Step Calculation With Examples

Payroll Tax Deductions Business Queensland

Payroll Formula Step By Step Calculation With Examples

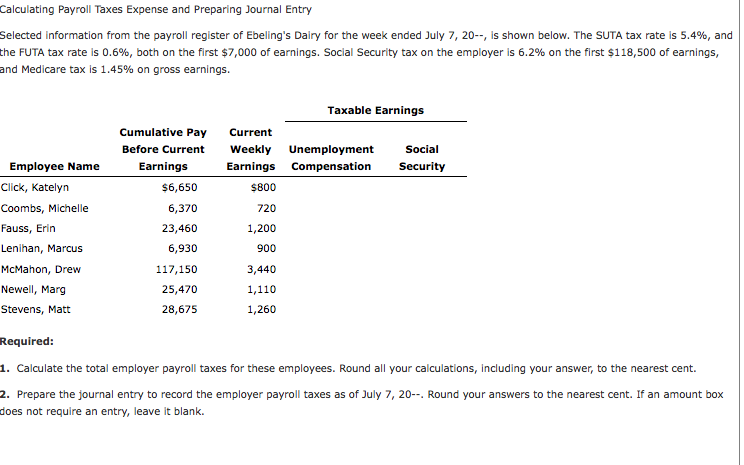

Payroll And Payroll Taxes Accounting In Focus

How To Calculate Taxes On Payroll Clearance 52 Off Www Ingeniovirtual Com

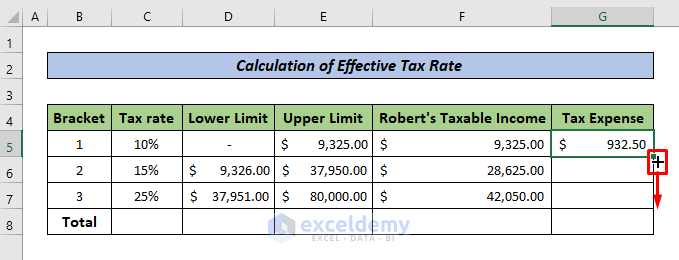

How To Calculate Federal Tax Rate In Excel With Easy Steps

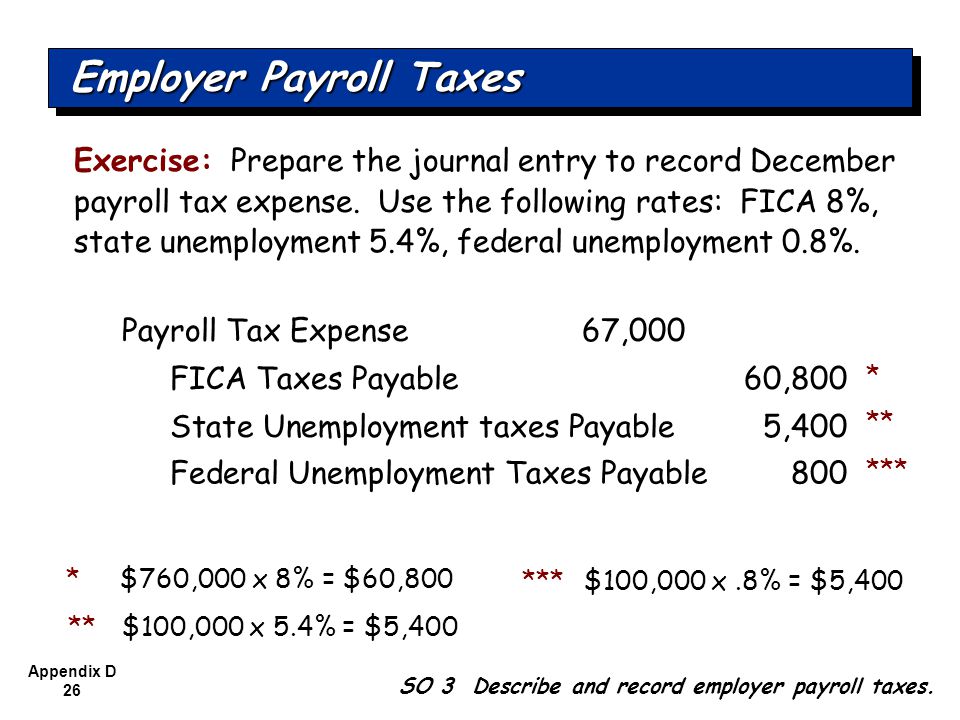

Financial Accounting Sixth Edition Ppt Download

Payroll Journal Entries Financial Statements Balance Sheets Video Lesson Transcript Study Com

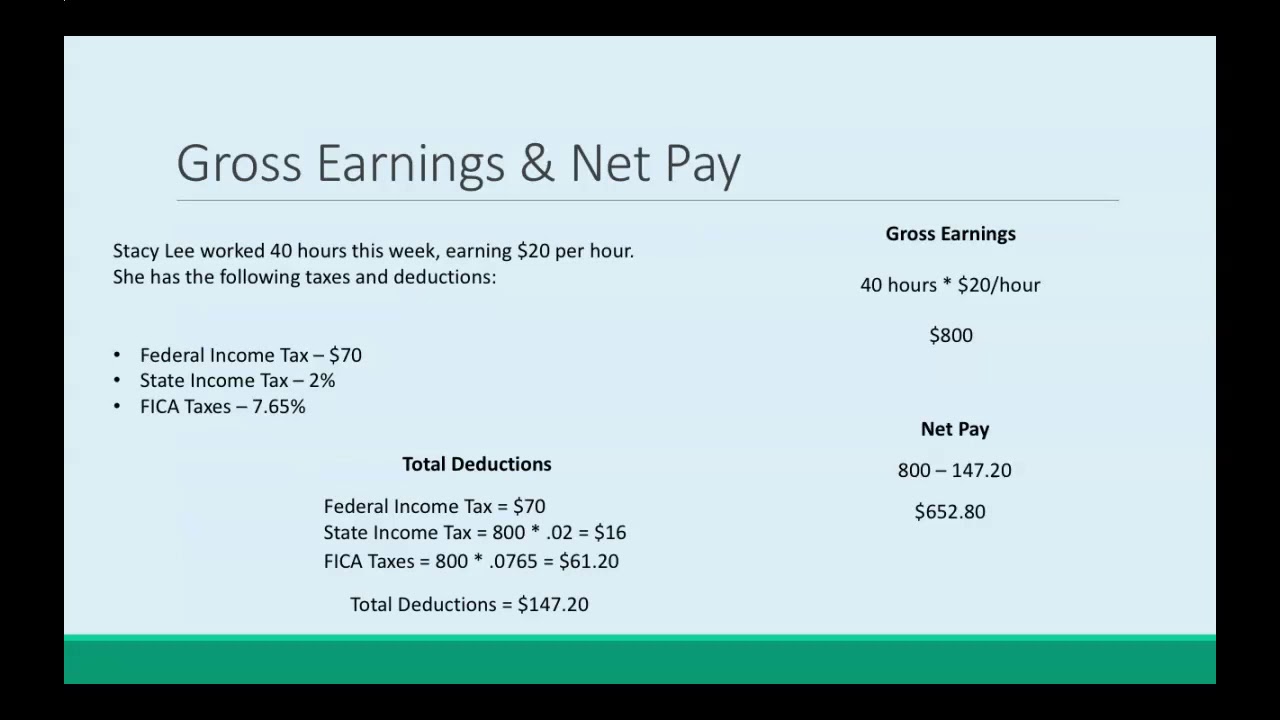

Federal Income Tax Fit Payroll Tax Calculation Youtube

Taxable Income Formula Examples How To Calculate Taxable Income